With over 2 million distressed properties in the market, understanding the urgent nature of these sales is important. These homes are typically below market value and need quick transactions. The demand for distressed homeowner leads has surged due to economic shifts and an increase in foreclosures.

So, how will you gather the leads?

To get the leads, use online platforms and real estate databases like Swordfish AI that specialize in distressed properties. With its help, you may more easily locate and contact homeowners who are experiencing a crisis. Also, interact with real estate investment clubs along with direct marketing to target homeowners.

Here, we’ll go into more detail about how to get good leads from troubled homeowners and give you useful tips for managing this tough market effectively.

What are Distressed Homeowner Leads?

Distressed homeowner leads are properties that are in a state of financial distress, often due to circumstances like foreclosure, bankruptcy, or inability to maintain mortgage payments. These real estate leads represent potential investment opportunities in the real estate market.

According to data, one in every 2,112 homes in the U.S. experienced foreclosure in the first half of 2021. Now, these leads are valuable in real estate markets. They help investors and realtors find properties that are often sold below market value. This creates a lucrative opportunity for quick and profitable transactions.

Typically, these properties come from various distress situations like divorce, tax liens, or imminent relocations. Each scenario pushes the homeowner to sell under pressured circumstances.

Real estate opportunities can be found more easily when you know how to find leads from distressed homeowners. With this information, specific plans can be made to reach out to homes that want to sell the property quickly and for less money.

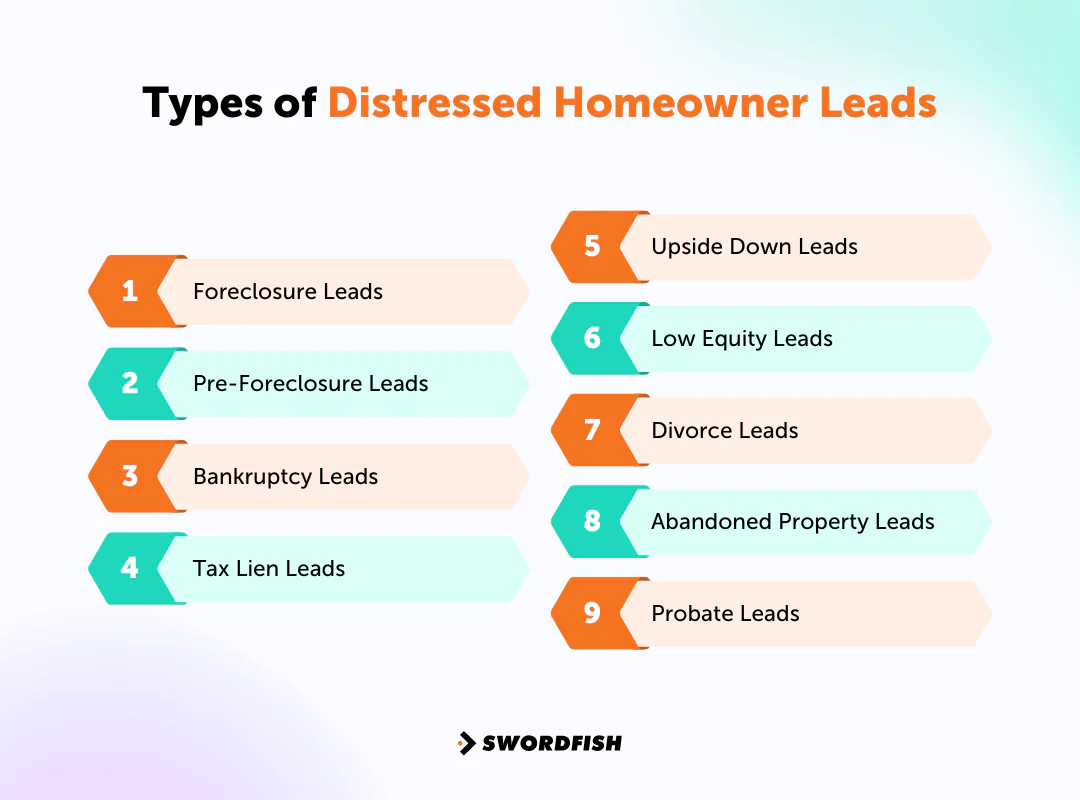

Types of Distressed Homeowner Leads

Leads from distressed homeowners come from various challenging situations. These types of leads represent opportunities for real estate investors.

Foreclosure Leads

People who have stopped making their mortgage payments are the ones who send in foreclosure leads. Initially, the bank takes back the property. Foreclosure homeowners are desperate to keep their homes so they don’t lose them and hurt their credit, which could mean good deals for buyers.

Pre-Foreclosure Leads

Pre-foreclosure leads occur when a homeowner has missed payments and the lender has issued a warning. These properties haven’t been foreclosed yet, giving investors a chance to negotiate directly with the owner who might be eager to sell to avoid foreclosure.

Bankruptcy Leads

When a homeowner files for bankruptcy, they might need to sell their property to settle debts. This process is stressful for the owner and can lead to sales below market value, as they rush to resolve their financial troubles.

Tax Lien Leads

Tax lien leads are generated when homeowners fail to pay property taxes. The government places a lien on these properties. Investors can buy these liens and may eventually own the property if taxes remain unpaid, offering a unique investment path.

Upside Down Leads

Upside down leads refers to situations where homeowners owe more on their mortgage than the property’s current value. These homeowners might sell to escape financial strain, often resulting in deals below market value.

Low Equity Leads

People who have a home and a debt that is almost paid off send low equity leads. They don’t have much financial room to move if they’re having money problems, which usually leads to a quick sale at a lower price to avoid more problems.

Divorce Leads

Divorce can force the sale of a property as couples look to divide assets. This often results in motivated sellers who want a quick transaction to start the separation process, potentially under market value.

Abandoned Property Leads

Properties become abandoned when owners neglect them due to various reasons, such as financial distress or relocation. These properties often require significant repair, offering substantial rehab potential for investors.

Probate Leads

Probate leads arise when a property owner passes away and the estate goes through probate. Heirs may want to liquidate the property rather than manage it, leading to potential investment opportunities at reduced prices.

How to Get the Best Distressed Homeowner Leads

Here, to successfully find the leads from distressed homeowners, we’ll go through targeted strategies so that you can have profitable investments:

1. Using Swordfish AI: Get the Best Distressed Homeowner Leads

If you’re targeting distressed property or homeowner leads, you understand the importance of efficiency and precision. Imagine having a tool that simplifies your search for personal contact information, including cell phone numbers and mailing addresses, with outstanding accuracy. That’s what Swordfish AI offers you.

With a 33% improvement in locating accurate cell phone numbers and a 45% higher precision than competitors, Swordfish AI ensures you receive the most reliable information through its instant verification process.

Swordfish AI stands out with its strong database of 3.5 billion profiles, meticulously organizing the process of finding the right contacts for you. It also comes equipped with a useful Chrome extension that captures data effortlessly from LinkedIn, Facebook, and other websites.

But Swordfish AI doesn’t stop there.We understand that your needs are unique. Therefore, we offer advanced search functions that thoroughly check the basic factors like location and property type.

You can personalize your searches using criteria such as potential equity, historical property data, and even seasonal trends, enabling you to target precisely and effectively.

Key Features of Swordfish AI

Swordfish AI offers advanced features to optimize the sourcing of distressed homeowner leads throughout the US. You can use some of these best contact finding tools offered by Swordfish AI to ensure you can connect with highly motivated homeowners effectively.

Chrome Extension

The Swordfish Chrome Extension allows users to instantly access contact data on platforms like LinkedIn, Facebook, and Twitter. For distressed homeowner leads, this means quick retrieval of essential contact information directly from social profiles.

Prospector

Prospector allows you to generate and download lists of leads based on specific criteria. For those seeking distressed property leads, it can filter prospects experiencing financial difficulties or in pre-foreclosure stages across any state.

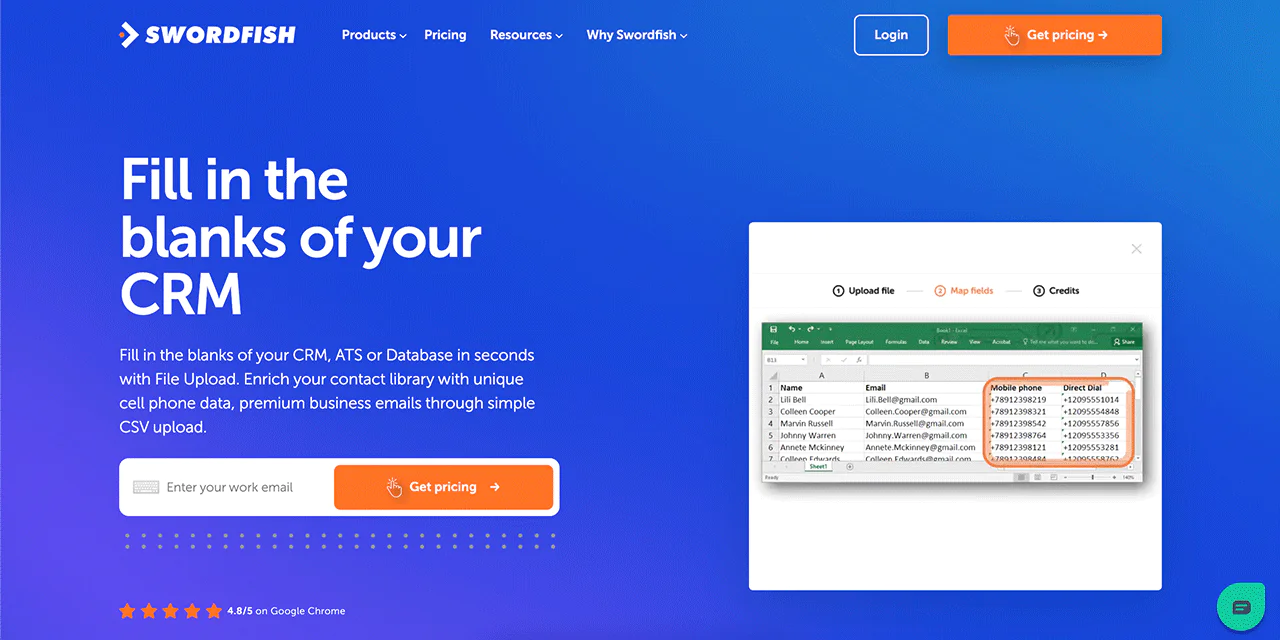

File Upload

File Upload feature lets you upload a CSV file and automatically fills in missing contact details. It’s invaluable for real estate professionals looking to update their databases with recent information on distressed homeowners.

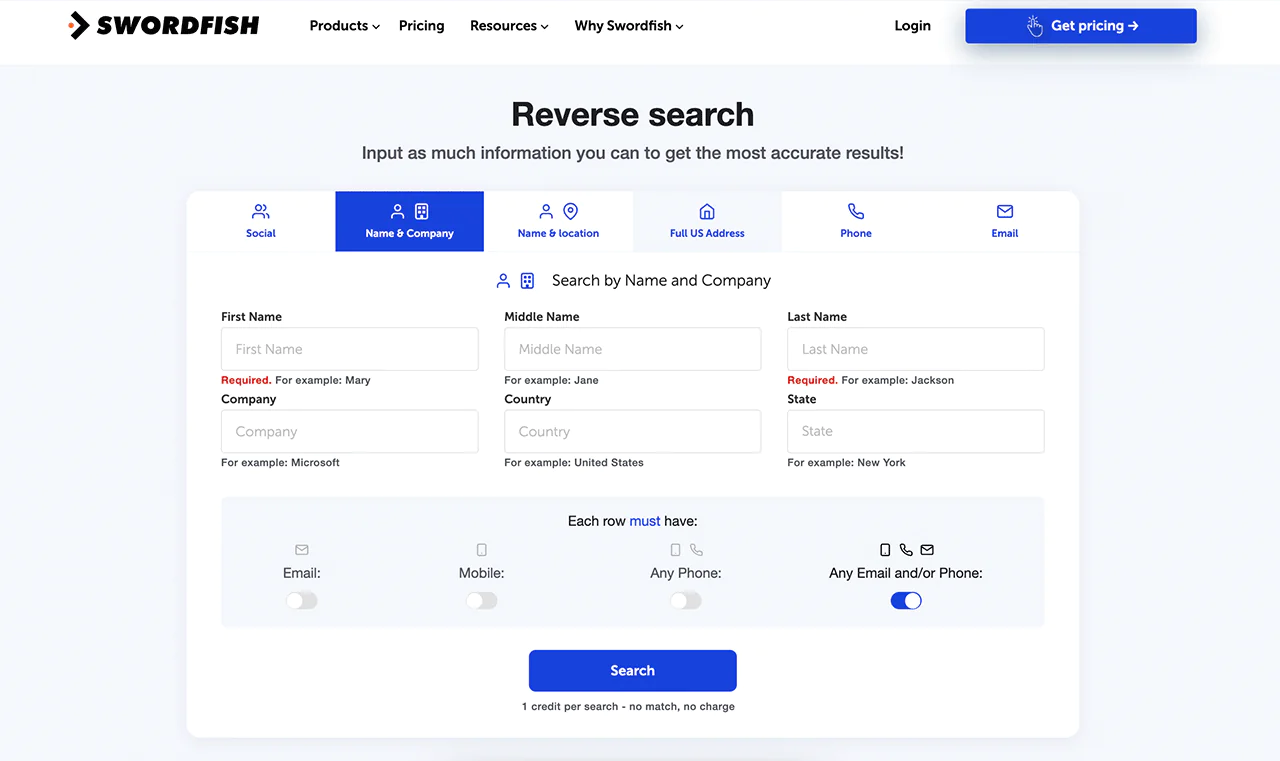

Reverse Search

Use Reverse Search to find out more about a possible lead, even if you only know a little about them. If you enter a partial name, phone number, or location, you will get a full report that can help you connect the dots and get in touch with distressed homeowners.

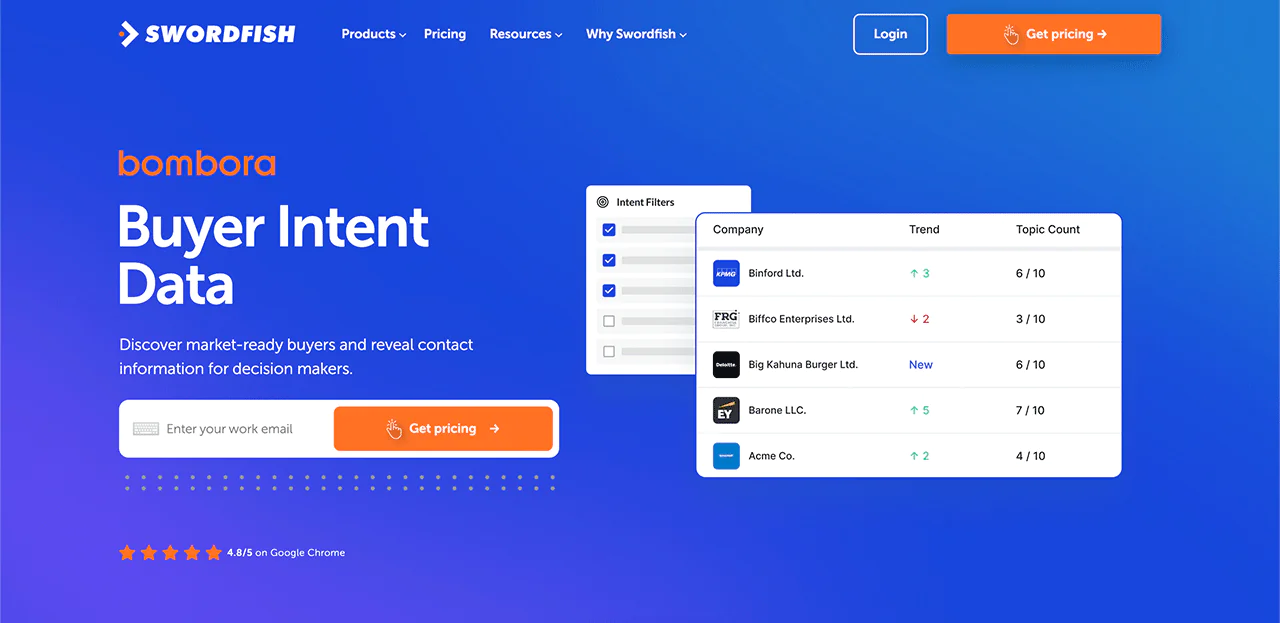

Bombora

Swordfish’s integration with Bombora provides intent data, identifying businesses likely needing real estate solutions. This can guide you to distressed companies that may need to liquidate properties, including homes.

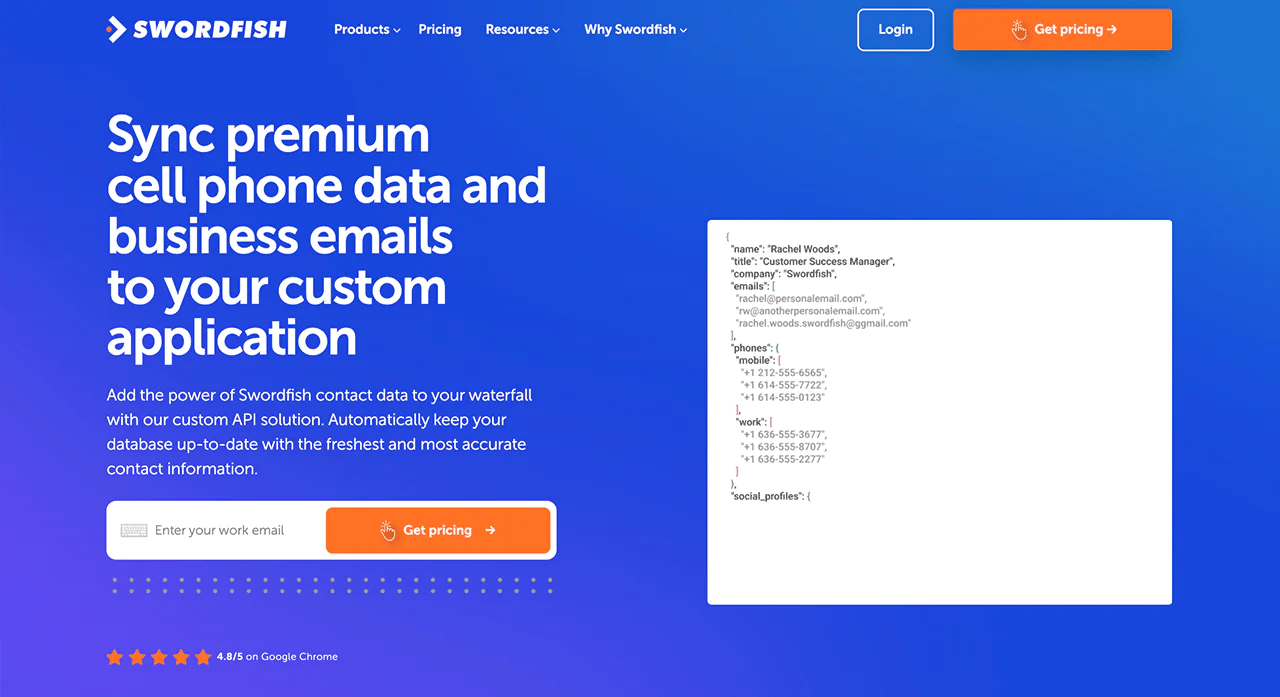

API

The Swordfish API integrates with other platforms to improve applications with its unique data capabilities. This makes it easier for real estate agents who are looking for distressed homes to get accurate, up-to-date information about the homeowners.

2. Utilize Specialized Databases

There are databases that use specialized databases that list distressed properties such as foreclosures, bank-owned homes, and properties with tax liens. These databases are important if you’re looking to find properties you can buy for less than their market value.

In 2021, over 50% of users found valuable leads using these databases. You can filter your search by location, property type, and how urgent the sale is, helping you quickly find deals that fit your investment goals.

This method isn’t just fast; it also lets you scan multiple markets for potential deals efficiently.

3. Engage in Direct Marketing

Engage in direct marketing by reaching out personally to homeowners in distress. These homeowners may be facing foreclosure, dealing with unpaid property taxes, or needing to sell quickly due to personal circumstances.

Send personalized letters or postcards that address their specific needs and offer a viable solution to start negotiations. This method can help you acquire properties at below-market value. With around 3.5% of homes facing foreclosure each year, there’s a significant market to target.

This approach not only helps homeowners in difficult situations but also allows them to find potential deals that others might miss.

4. Attend Real Estate Auctions

Attend real estate auctions to get direct access to distressed properties, which are often sold by banks or financial institutions looking to recover debts. At these auctions, properties may be available at significantly reduced prices, often 20% to 40% below market value.

To be successful at auctions, you need to be ready to make quick decisions and accurately assess the value of properties, as well as any potential repair costs. The competitive nature of auctions means that being well-prepared can significantly impact the success of your investments.

By attending real estate auctions, you can quickly generate leads by connecting directly with sellers, giving you a chance to secure deals on the spot.

5. Network with Industry Professionals

Building strong relationships with real estate agents, lawyers, and court officials can provide insider information on distressed properties before they hit the market.

These professionals often have advanced knowledge of properties in financial distress, upcoming foreclosures, or estates in probate. Approximately 30% of real estate deals in some markets are sourced from industry referrals, underscoring the importance of networking.

You should nurture these relationships, which can lead to a steady flow of leads through referrals, giving you an edge over competitors.

6. Utilize Online and Social Media Platforms

Digital platforms and social media can be highly effective for identifying and connecting with distressed homeowners. Using targeted ads on platforms like Facebook, LinkedIn, or Google allows you to reach specific groups of homeowners who may be in a tough financial situation.

These platforms permit detailed targeting based on demographics, location, and even interests, aligning with the characteristics of distressed property owners.

You can optimize LinkedIn for sales prospecting to expand your network and find more distressed homeowner leads through targeted outreach.

7. Explore Legal Filings and Public Records

Public records and legal filings are invaluable resources for finding distressed properties. By regularly examining foreclosure notices, divorce records, and probate sales, investors can find properties that may not be listed on traditional markets.

This method requires diligent research and an understanding of local laws to effectively identify and act on these opportunities. It provides a potential edge in finding lucrative deals that are overlooked by others.

8. Use Property Management Companies

These companies handle many rental properties that could turn into distressed sales due to reasons like non-payment of rent or the landlord’s financial troubles.

Building a good relationship with these companies can give you early warnings about properties that might soon be available for sale. Having early access to such information allows you to negotiate directly with property owners.

This can help you secure deals before they become widely known or advertised. This approach gives you a head start in finding potential investment opportunities.

9. Subscribe to Bank and Asset Management Listings

Banks and asset management companies frequently list their distressed properties for sale, often before these listings are made public.

By subscribing to their newsletters or maintaining regular contact with asset managers, you can receive early notifications of new distressed properties.

This method ensures that you are among the first to view new listings, providing a competitive advantage in the market.

10. Participate in Real Estate Investor Clubs

Join local real estate investor clubs to tap into valuable partnerships and get insider tips on the leads from distressed homeowners that aren’t widely known. These clubs regularly host meetings where you can learn about the local market, investment strategies, and upcoming deals.

By actively participating, you’ll expand your network and gain deep insights into securing leads on distressed properties. This involvement is key to growing your investment portfolio and finding unique opportunities before they hit the mainstream.

Who Needs Distressed Homeowner Leads?

If you’re involved in real estate or related sectors, understanding the importance of distressed homeowners or property leads can transform your business approach.

These leads are needed for those looking to connect with homeowners in pressing financial situations or properties under potential foreclosure

Real Estate Investors

If you’re an investor seeking opportunities to buy properties at a lower market value, distressed homeowner leads are invaluable.

These leads provide insight into properties that might be sold under market price due to financial distress. For example- foreclosures or bank-owned properties, offering high returns on investment.

Real estate agents and investors can benefit from these enterprise sales prospecting tips customized to the nuances of the distressed property market.

Real Estate Agents

For real estate agents, these leads are a pathway to new listings and potential sales. By helping homeowners navigate through challenging times, you can facilitate faster sales and earn commissions. You can also build an image as a helpful and effective agent in tough conditions.

Property Flippers

If you specialize in flipping homes, purchasing distressed properties can significantly increase your business. These properties often require renovations and can be acquired at competitive prices.

It allows for substantial profit margins once improvements are made and the home is resold.

Wholesalers

For those in the real estate wholesaling business, leads from distressed property owners can lead to profitable deals. You can secure properties at lower costs and sell the contracts to end buyers for a quick profit, without ever holding the actual property.

Debt Relief Services

Companies offering debt relief or financial services can use distressed homeowner leads to identify potential clients who may need their services. Offering solutions to manage or consolidate debts can provide relief to homeowners and prevent foreclosures.

How Much Do Distressed Homeowners Leads Cost?

It’s important to know how much distressed homeowner leads cost when making budgets and plans for real estate-related tasks. Let’s find out more details about it:

Subscription Services

Subscription services may offer monthly packages that range typically from $50 to $500 per month, depending on the number of leads and the depth of data provided. These subscriptions often include tools and support to help maximize the value of the leads.

Pay-Per-Lead

Some platforms offer leads on a pay-per-lead basis, where you can expect to pay anywhere from $1 to $5 per lead. This option is beneficial for those who prefer a less committal approach, allowing users to purchase only what they need without ongoing commitments.

Bulk Purchases

Buying leads in bulk can significantly reduce the cost per lead. For example, packages may contain hundreds of leads and cost several hundred dollars, effectively lowering the price to under a dollar per lead.

It is a common strategy for larger companies or those with extensive outreach programs.

Custom Lead Generation

Custom lead generation services, which personalize the lead criteria to your specific needs, can be more costly. Prices can range from $500 to over $1,000 for a set of highly targeted leads.

This service is ideal for those who have very specific criteria and are targeting a narrow, highly defined market segment.

Online Marketplaces

Online platforms and marketplaces may offer leads at varying prices based on competitiveness and demand in specific areas. Here, prices can range widely but generally fall between $2 and $10 per lead, influenced by market conditions and lead exclusivity.

Conclusion

It’s important to find the best distressed homeowner leads, but it can be tricky because you need accurate and up-to-date information. Most of the time, it’s hard to get rid of old contacts and carefully combine data from different sources.

This is where Swordfish AI shines the brightest. It excels by providing the most current and useful data, ensuring top-notch distressed home seller leads. So, try Swordfish AI now to connect faster and more effectively with distressed homeowners facing challenges.

Frequently Asked Question

What is a distressed seller?

A distressed seller is a homeowner who needs to sell their property quickly due to financial difficulties, such as foreclosure, bankruptcy, or other economic hardships. These situations often force the sale of the property at a price below market value.

What are distressed homeowner leads for sale?

Distressed homeowner leads for sale are lists of properties or homeowners who are in a financial bind and may need to sell their homes quickly. These leads are valuable for investors and real estate agents looking for opportunities to purchase properties at a reduced price.

Will I need free distressed homeowner leads?

While free distressed homeowner leads can be a cost-effective starting point, platforms like Swordfish AI offer more reliable data with an accuracy rate that surpasses many competitors by 45%. Real estate investing in quality leads often results in more successful outcomes and better utilization of your time.

How can I find a distressed property list?

You can find a distressed property list through online databases, real estate websites, and foreclosure listing services. Another effective method is using tools like Swordfish AI, which provide detailed and up-to-date information on distressed properties across various regions.

Why should I buy distressed property leads?

Buying distressed property leads provides you with a direct line to homeowners who are motivated to sell quickly, often at a price below market value. This can significantly benefit real estate investors and agents by increasing the chances of securing a profitable deal.

How often should I follow up with leads of distressed homeowners?

Following up with the leads of distressed homeowners should be done diligently but respectfully. A good practice is to contact them initially and then follow up every few weeks, adjusting based on their feedback and readiness to proceed. Persistent yet thoughtful follow-up is key to building trust and keeping you top of mind.

What are off market motivated seller leads?

Off-market motivated seller leads are contacts for property owners who haven’t listed their property but are keen to sell. These leads can be valuable as they often involve sellers eager for a quick transaction, potentially allowing buyers to secure properties at favorable prices.

View Products

View Products