Understanding the costs associated with hiring a financial advisor is essential as it helps you budget accurately and ensures you’re not overpaying for financial guidance. Also knowing the specifics of financial advisor fees and costs can impact your overall investment strategy and the growth of your financial assets.

So, how much does it cost to hire a financial advisor?

The cost of hiring a financial advisor can vary widely. Fees typically range from 0.25% to 1% of assets under management annually. Some advisors may charge flat fees from $1,000 to $7,500 or hourly rates between $200 and $400, depending on the services provided.

Our guide provides the costs of hiring a financial advisor, including potential hidden fees and what you can expect in terms of service and support.

Read on to make a well-informed decision about choosing the right financial advisor for your needs.

What Is a Financial Advisor?

A financial advisor is a professional who helps individuals manage their finances, focusing on investments, budgets, retirement planning, and insurance. Their expertise supports clients in achieving financial security and meeting their personal financial goals.

Financial advisors assess your financial situation, identify your financial goals, and develop strategies to meet those goals. They offer guidance on investment choices, savings, estate planning, and tax strategies.

By creating personalized financial plans, they help you optimize your financial health and ensure long-term security.

What are the Types of Financial Advisor?

Financial advisors come in various forms, each offering different services and expertise. Here’s a breakdown of the main type of advisors:

Robo-Advisors

These are automated platforms that provide financial planning services online with minimal human interaction. They use algorithms to manage your investments based on your risk tolerance and goals. Robo-advisors are known for their low fees and are suitable for those with straightforward financial needs.

Online Financial Advisors

This category includes digital-first firms that offer financial advice through online platforms, often combining algorithms with human advisors. These services are typically more affordable than traditional advisors and can provide a range of services, from investment management to financial planning.

Certified Financial Planners (CFP)

Professionals who have earned the CFP designation have completed extensive training and are held to a high ethical standard. They provide holistic financial planning services, including budgeting, estate planning, tax strategies, and insurance advice.

Traditional Financial Advisors

These advisors provide in-person, comprehensive financial planning and investment management. They might work independently or as part of a financial institution. Traditional advisors are ideal for individuals with more complex financial situations or those who prefer face-to-face interaction.

Registered Investment Advisors (RIA)

RIAs provide investment advice and are registered with either the Securities and Exchange Commission or state securities regulators. They have a fiduciary duty to act in their clients’ best interests and often offer more personalized investment advice.

Wealth Managers

Wealth managers typically serve high-net-worth individuals and offer services that cover all aspects of wealth management, including estate planning, managing concentrated stock positions, and complex tax situations.

Financial Coaches

Unlike traditional financial advisors who often focus on investments, financial coaches help clients establish budgets, improve their credit, and develop better money habits. Coaching usually focuses on education and behavioral change rather than direct investment advice.

Why Hire a Financial Advisor?

Hiring a financial advisor can be a significant decision that helps you determine complex financial sectors and achieve your long-term goals. Here are some compelling reasons why you might consider hiring a financial advisor:

Expert Financial Planning

Financial advisors bring expert knowledge of markets, investment strategies, and financial planning. They can provide you with insights and guidance that you might not have the time or expertise to develop on your own.

Personalized Strategy

A financial advisor can customize a financial strategy that aligns with your personal goals, risk tolerance, and life circumstances. Whether you’re planning for retirement, saving for a home, or managing wealth across generations, an advisor can craft a plan suited specifically to your needs.

Improved Investment Performance

Professional management can lead to higher investment returns. Financial advisors have the tools and knowledge to optimize asset allocation and diversify investment portfolios effectively.

Risk Management

Financial advisors help manage risk by ensuring your investment portfolio aligns with your risk tolerance and life stage. They can adjust your portfolio in response to market changes and personal circumstances, helping to protect against significant financial losses.

Behavioral Coaching

One of the less tangible but highly valuable benefits of having a financial advisor is their role in coaching you through market volatility and helping you make rational financial decisions. They provide a buffer against making impulsive decisions based on emotions, which is a common pitfall for many investors.

Comprehensive Financial Oversight

Financial advisors can oversee all aspects of your financial health, including estate planning, tax strategies, and insurance needs. They ensure that all pieces of your financial puzzle work together cohesively, which can be difficult to manage without professional help.

Time Savings

Managing your finances, especially if you have a diversified portfolio or complex financial situations, can be time-consuming. A financial advisor can take over these tasks, freeing up your time for personal, career, or family interests.

How Much Does a Financial Advisor Cost?

How much does a financial advisor makes depends mainly on the fee structure they use. Here are the most common ways advisors might charge you:

Assets Under Management (AUM):

- Percentage-Based Fee: Typically around 1% of the assets they manage for you per year.

- Description: This fee model aligns the advisor’s incentive with your portfolio’s performance; as your assets grow, so does the advisor’s fee. Thus motivating them to focus on improving your financial outcomes.

- Example: If you have $100,000 managed by an advisor charging 1%, you would pay $1,000 annually.

- Note: Lower percentages may apply for larger investments or if using a robo-advisor, which generally charges between 0.25% to 0.50%.

Flat Fees:

- Annual Charge: Ranges from $2,000 to $7,500.

- Description: Flat fees are straightforward and predictable, making budgeting easier. They are typically suited for ongoing advice and can cover comprehensive services or specific financial tasks.

- Consistency: This fee does not fluctuate with the value of your assets, providing predictability in financial planning costs.

Hourly Fees:

- Rate: Typically between $200 to $400 per hour.

- Description: Ideal for when you need financial advice on an as-needed basis. This can be a cost-effective option if you require assistance with specific issues or decisions rather than continuous management.

- Use Case: Ideal for specific, short-term financial guidance or particular tasks rather than ongoing management.

Per-Plan Fees:

- One-Time Fee: Usually between $1,000 and $3,000 for a comprehensive financial plan.

- Description: This fee covers the creation of a detailed, personalized financial plan. You pay once for the plan and execute it on your own, without ongoing advisor engagement.

- Service: Includes a detailed plan based on your financial situation but does not include ongoing management or adjustments.

Commission-Based:

- Earnings: Advisors earn money through commissions on financial products like mutual funds and insurance that they sell to you.

- Description: While potentially less upfront cost to you, this model can lead to biases in recommendations. It’s important to ensure that any products recommended are truly in your best interest.

- Considerations: This might introduce a conflict of interest, as advisors could be incentivized to recommend products that provide them higher commissions.

Combination of Fees:

- Description: Advisors might combine different types of fees based on the services provided.

- Example: An AUM fee for ongoing investment management plus a flat fee for an annual financial plan.

- Suitability: Useful for those who need both regular management and periodic comprehensive planning.

Here is comparison table of the different pricing structures for hiring a financial advisor:

Fee Type | Typical Range or Rate | Recommended For |

Assets Under Management (AUM) | 0.25% to 1% annually | Ongoing portfolio management |

| Flat Fee (Retainer) | $2,000 to $7,500 annually | Regular, comprehensive financial guidance |

Hourly Rate | $200 to $400 per hour | Specific financial inquiries or projects |

| Per-Plan Fee | $1,000 to $3,000 | Individuals seeking a one-time detailed financial plan |

Commission | Varies by product | Situations where product purchases are necessary |

| Combination of Fees | Varies | Complex financial needs requiring multiple services |

How Much Does a Financial Advisor Cost Reddit?

Here’s a summary of user opinions on the cost of hiring a financial advisor from the Reddit threads:

- High Advisory Fees Misunderstood: Users initially misunderstood advisory fees; one expressed shock upon realizing that a 1.35% fee applied to total assets annually, not just profits, leading to significant costs. This misunderstanding became particularly painful when the market performance was negative, resulting in a net loss after fees.

- Impact of High Fees on Returns: A user highlighted the severe impact of high fees, reporting a -23.4% return rate for the year, compounded by a 1.35% fee, leading to a total loss of nearly 24.75% on their investment. This underscores the detrimental effect of advisor fees on poor market returns.

- Preference for Lower-Cost Alternatives: In response to high fees, some users recommend more cost-effective alternatives like Vanguard, which charges around 0.3% for investment management. This lower fee is favored as it aligns better with the long-term growth of investments without the hefty cost burden.

- Reevaluation of Advisor Value: Users express regret over high advisory fees, especially when the financial performance does not meet expectations; one user paid $8,000 yearly without seeing market-beating returns. This has led to a broader discussion about the real value of financial advisors and whether their fees are justified by their performance.

- Exploring Fee-Only Advisory and Hourly Rates: There is a growing interest in fee-only advisors who charge by the hour, around $350, rather than taking a percentage of assets managed. This approach is seen as a way to control costs and align fees more directly with the value of the services provided.

- Personal Management as a Cost-Saving Measure: Many users recommend managing investments oneself using low-cost index funds, which can save on high management fees. This preference is supported by studies showing that actively managed funds rarely outperform passive indexes after accounting for fees.

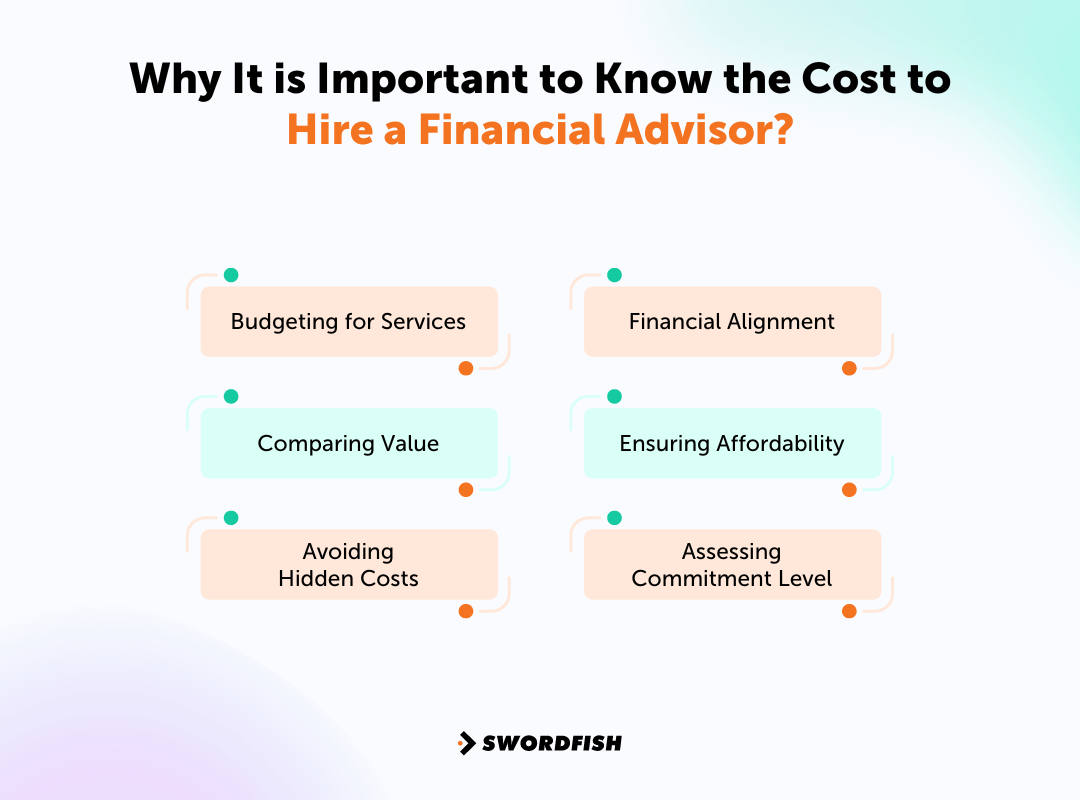

Why It is Important to Know the Cost to Hire a Financial Advisor?

Knowing the cost to hire a financial advisor is crucial for several reasons, each contributing to more effective financial management and planning:

Budgeting for Services

Understanding the fees associated with hiring a financial advisor helps you budget appropriately. This ensures that the cost of advice does not unexpectedly strain your financial resources, allowing you to plan your expenses effectively.

Comparing Value

When you know what different advisors charge, you can compare these costs against the services offered. This helps in evaluating whether you’re receiving good value for your money, which is vital in making an informed decision about which advisor to hire.

Avoiding Hidden Costs

Being aware of how much a financial advisor costs also helps you identify and avoid potential hidden fees. Knowing the fee structure can prevent surprises and ensure transparency in your financial dealings.

Financial Alignment

The cost of hiring an advisor should align with your financial goals and the complexity of your financial situation. For example, a simple financial situation may be well-served by an affordable robo-advisor, while complex finances might require the detailed guidance of a higher-priced advisor.

Ensuring Affordability

Understanding the costs involved ensures that the services of a financial advisor are affordable in the long run. This is important because, ideally, the benefit derived from financial advice should outweigh the costs, not just at the onset but throughout the relationship.

Assessing Commitment Level

Knowing the costs helps you assess how much commitment you are making towards managing your finances. It might influence how deeply you engage with financial planning services and how you prioritize different financial goals.

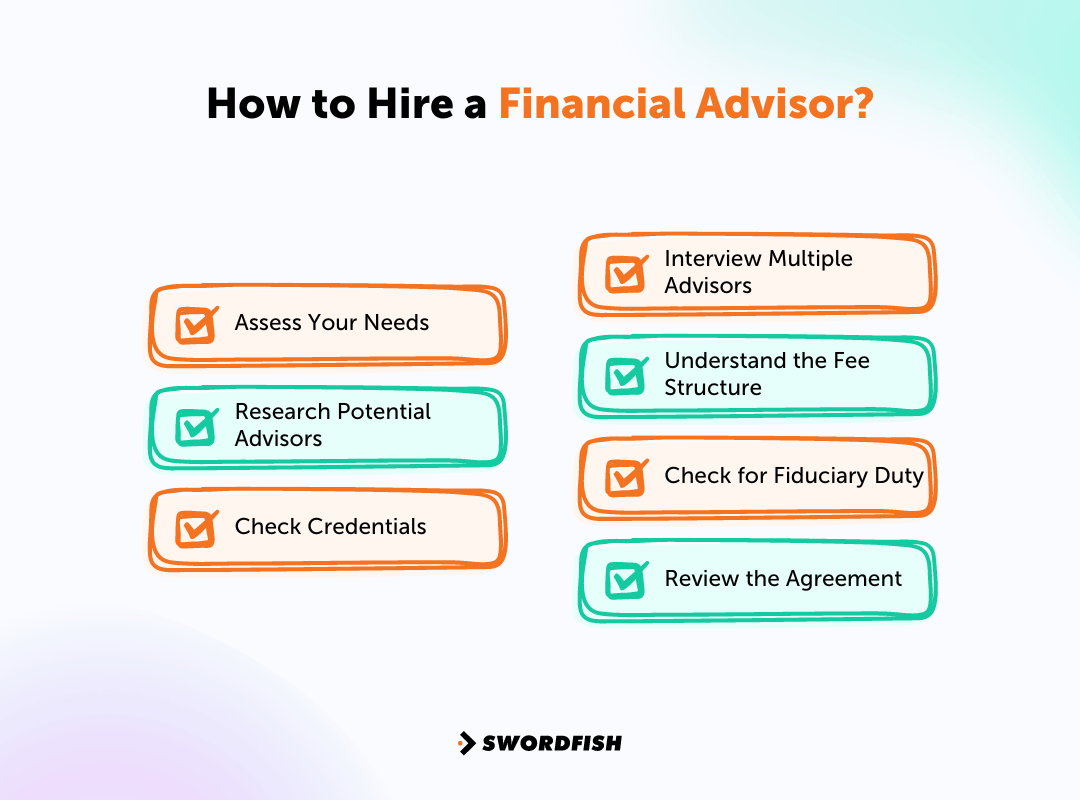

How to Hire a Financial Advisor

Hiring a financial advisor can seem daunting, but with the right approach, you can find someone who fits your needs. Here’s a simple guide on how to do it:

Assess Your Needs

Think about what you need help with. Is it investments, retirement planning, debt management, or all of the above? Knowing your needs helps you find a financial advisor who specializes in those areas.

Research Potential Advisors

Start by asking friends or family for recommendations. You can also look online for financial advisors in your area. Check their credentials and read reviews to see what other clients say about their services.

Check Credentials

Look for certifications like Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). These credentials indicate that the advisor has a certain level of expertise and ethics.

Interview Multiple Advisors

Don’t settle on the first advisor you meet. Interview a few to compare their services, fees, and the rapport you have with them. Ask about their experience, investment philosophy, and how they communicate with clients.

Understand the Fee Structure

Make sure you understand how the advisor gets paid. Some work on a fee-only basis, others may receive commissions on products they sell, and some use a combination of both. Choose the model that aligns with your comfort level.

Check for Fiduciary Duty

It’s important that the advisor is a fiduciary, meaning they are legally required to put your interests above their own.This commitment provides a deeper level of trust and protects you from biased advice.

Review the Agreement

Before you finalize anything, carefully review the contract or agreement. Make sure you understand all terms, what services will be provided, and how you can terminate the relationship if needed.

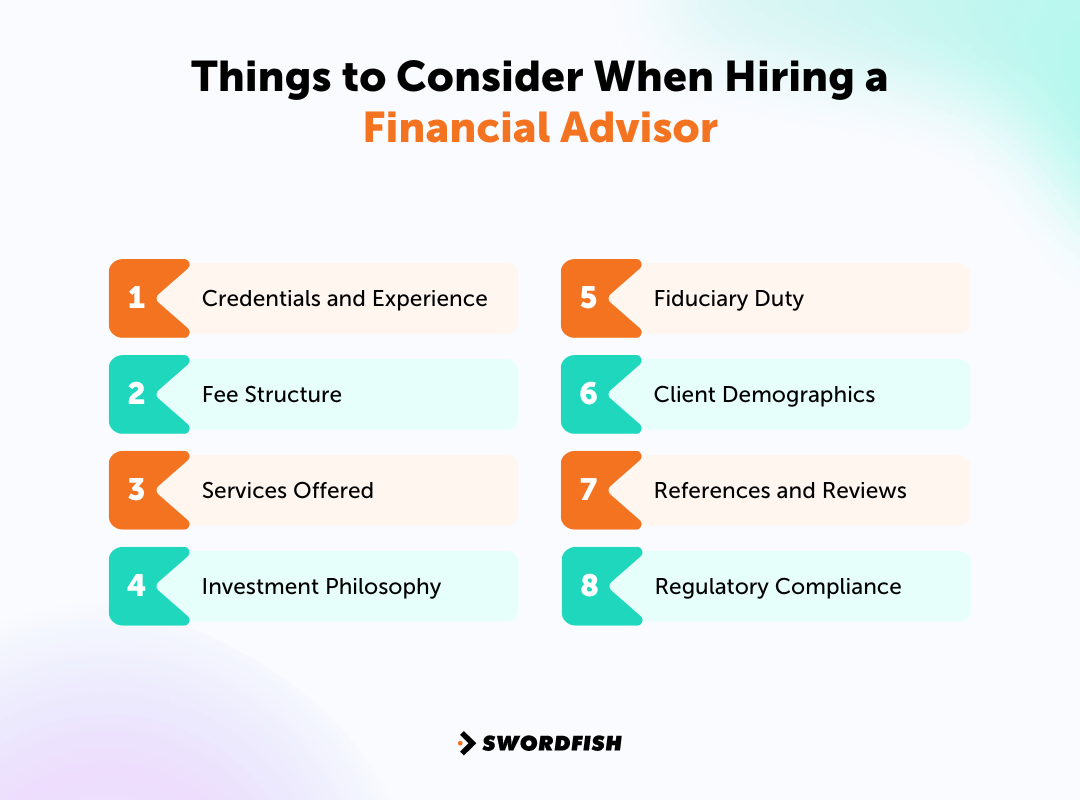

Things to Consider When Hiring a Financial Advisor

When hiring a financial advisor, thoroughly evaluating various key aspects can help ensure you find the right financial professional for your needs. Here’s a detailed look at each consideration:

Credentials and Experience

Look for advisors with recognized credentials like CFP or CFA, which indicate a level of professional education and ethical commitment. Additionally, inquire about their experience, particularly in areas that match your financial goals, such as investment management or retirement planning.

Fee Structure

Understand how the advisor is compensated to assess potential conflicts of interest. Fee-only advisors are compensated directly by their clients for advice. While fee-based advisors might also receive commissions from financial products they sell, which could influence their recommendations.

Services Offered

Determine the range of services the advisor offers. Whether you need help with specific investments, comprehensive financial planning, estate planning, or all of these, ensure the advisor’s offerings align with your requirements.

Investment Philosophy

Discuss the advisor’s investment strategies to ensure they align with your risk tolerance and financial objectives. Some advisors might focus on long-term growth using equities, while others might emphasize wealth preservation through bonds or other low-risk investments.

Fiduciary Duty

Ensure the advisor has a fiduciary duty to act in your best interest, which is legally binding. This reassures that the advice you receive aims to benefit you rather than the advisor’s own financial gain.

Client Demographics

Some financial advisors specialize in serving specific demographics like young professionals, retirees, or high-net-worth individuals. Matching their specialty with your situation can lead to more tailored advice and a better understanding of your unique needs.

References and Reviews

Research the advisor’s reputation through reviews and ask for references. Speaking to current and past clients can provide insight into the advisor’s reliability, performance, and client service quality.

Regulatory Compliance

Verify the advisor’s registration with appropriate regulatory bodies (like the SEC or FINRA in the U.S.) and check for any past disciplinary actions. A clean record suggests reliability and adherence to industry standards.

Conclusion

In this blog, we’ve broken down how much does it cost to hire a financial advisor, covering everything from standard fees to potential hidden charges. Knowing these costs is important—it ensures you can budget effectively and choose an advisor who fits your financial goals.

Without this knowledge, you might face unexpected fees that can throw off your financial planning. By staying informed, you can avoid these pitfalls and make sure the financial guidance you get is worth every penny.

Remember, understanding the full fee structure is key to a beneficial advisor-client relationship.

Frequently Asked Questions

Do financial advisors charge in other ways besides a percentage of assets?

Yes, financial advisors have diverse fee structures. They can charge flat fees for a specific service package, hourly rates for consultations, or per-plan fees for crafting detailed financial plans.

What is the cost difference between a certified financial planner and a financial coach?

Certified financial planners (CFPs) generally charge higher fees due to their extensive training and certification requirements, ensuring a high level of expertise. In contrast, financial coaches may charge less as they often provide more basic guidance and do not require the same level of certification.

Do financial advisors charge more for specialized investment advice?

Yes, when financial advisors provide specialized investment advice, especially in complex areas like tax planning or estate management, they typically charge higher fees. This reflects the additional expertise and time required to develop customized, strategic investment solutions.

Is it cheaper to hire a financial advisor online?

Yes, hiring an online financial advisor can often be more cost-effective than working with one in-person. Online advisors usually have lower operational costs, which allows them to offer competitive rates while still providing comprehensive financial services.

How much does a fidelity financial advisor cost?

The cost of a Fidelity financial advisor varies depending on the services and investment amount. Typically, Fidelity charges an annual fee that ranges from 0.50% to 1.50% of assets under management, aligning with industry standards for personalized financial advice.

View Products

View Products