When we survey financial advisors about their biggest marketing needs, 82.5% report that they do not have enough qualified leads to talk to each month.

This statistic highlights the significant challenge many advisors face in generating sufficient leads. The process of finding and nurturing potential clients can be daunting due to competition and the constantly changing nature of marketing strategies.

Hence, in the upcoming sections, we will look into effective and proven methods that can help secure more financial advisor leads. Stay till the end for insightful strategies that aim to transform your lead generation efforts.

What are Financial Advisor Leads?

Financial advisor leads are potential clients interested in investment or financial planning services. These leads represent individuals actively seeking guidance from financial professionals to manage their wealth effectively.

Leads are important for financial advisors as they provide a direct pathway to expanding their client base.

According to industry statistics, 88% of advisors are actively involved in converting these leads into clients. This high involvement highlights the importance of effective lead management and conversion strategies, as successful conversions directly impact an advisor’s client acquisition and business growth.

Effective lead management increases financial growth potential and enables advisors to offer customized financial solutions to a more diverse client base.

How to Get the Financial Advisor Leads

Looking to attract more financial advisor leads? You can start by utilizing social media platforms, engaging in networking events, and optimizing your website for SEO.

These methods are just the beginning. We’ve discussed many more effective strategies below that can help you expand your client base and grow your business.

Let’s see how you can get both paid and free financial advisor leads:

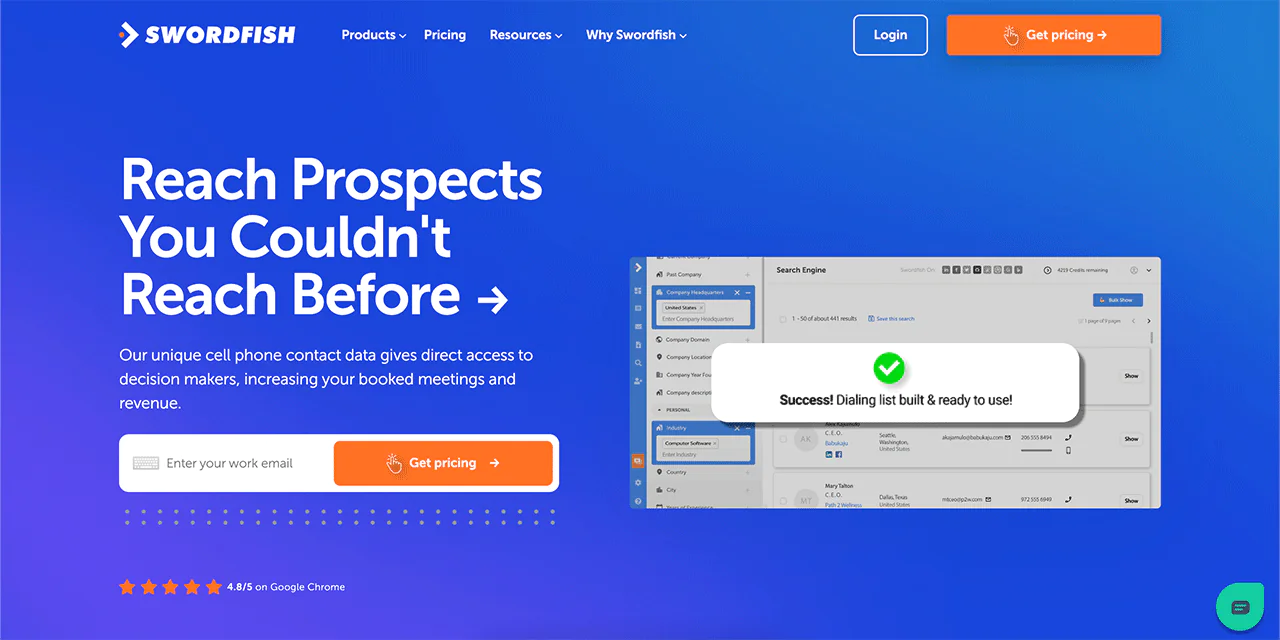

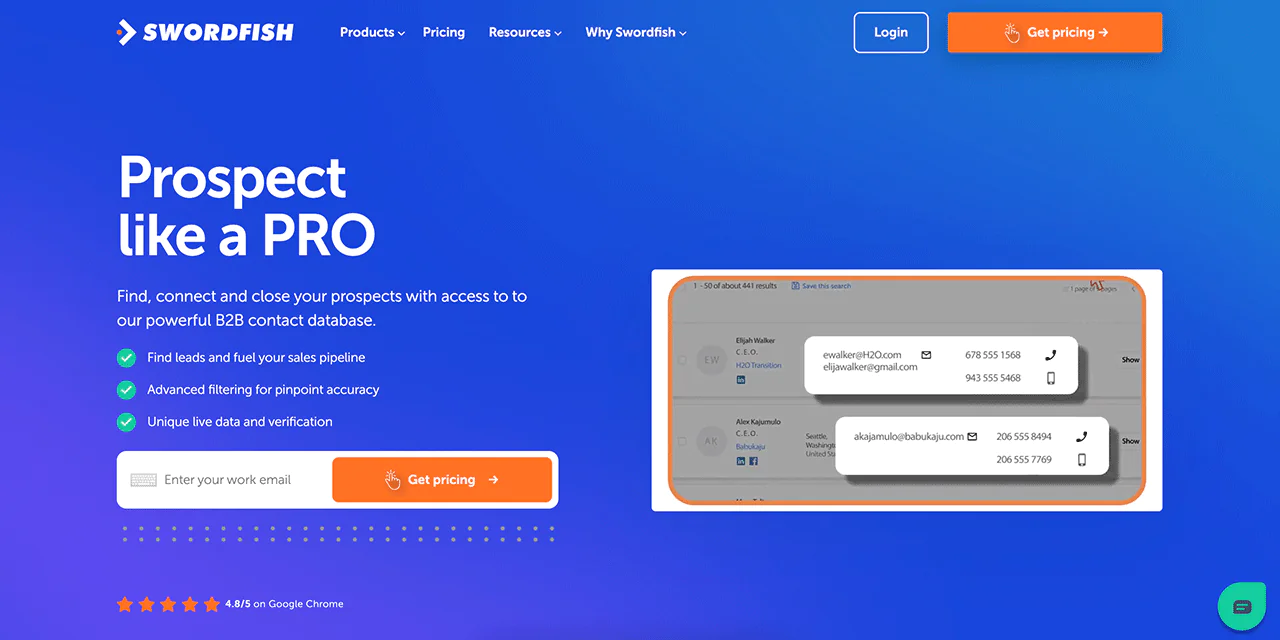

1. Using Swordfish AI: Get the Best Financial Advisor Leads

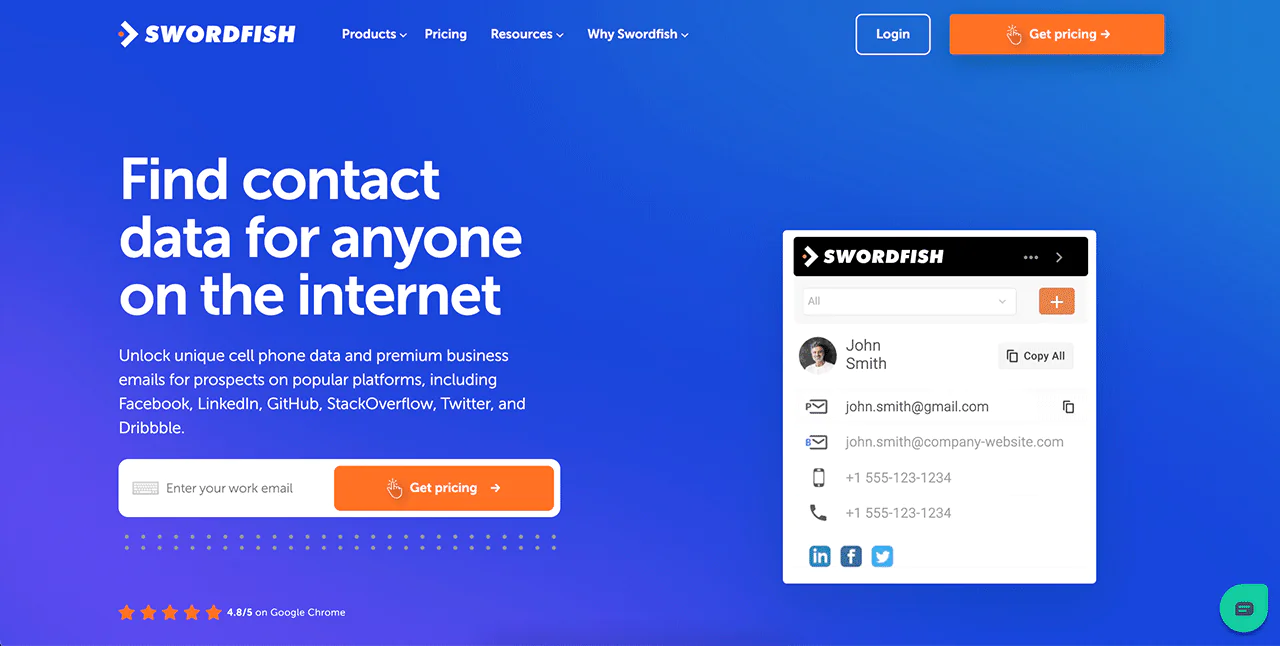

Swordfish AI is your go-to tool for securing top-quality list of financial advisor leads. With a huge database of over 3.5 billion profiles, you can easily access detailed contact information, including cell phone numbers and mailing addresses.

Its enhanced accuracy—33% better at locating cell phone numbers and 45% more precise than competitors—ensures you get reliable information quickly.

To enhance your outreach, the Chrome extension facilitates efficient data gathering from platforms like LinkedIn and Facebook. This integration simplifies your efforts and saves time.

Additionally, Swordfish AI’s advanced search capabilities allow you to customize your lead searches using criteria such as potential equity and historical data. This targeted approach helps you find exactly what you need.

Moreover, the platform’s automated campaign tools, equipped with templates and tracking features, support effective lead nurturing. These tools ensure that you maintain engagement with potential clients throughout the conversion process.

With Swordfish AI, connecting with valuable financial advisor leads is straightforward and effective, helping you expand your client base and grow your business with ease.

Key Features of Swordfish AI

Find how Swordfish AI’s strong features can enhance your lead generation for financial advisors:

Prospector

With Swordfish AI’s Prospector feature, you can pinpoint potential clients by filtering through a vast database. This tool helps you identify financial advisor leads that match your specific criteria, making your search more focused and productive.

Chrome Extension

Utilize the Swordfish AI Chrome Extension to seamlessly collect contact details directly from LinkedIn and Facebook profiles. This extension speeds up the process of gathering lead information while you browse, allowing you to build your leads list more efficiently.

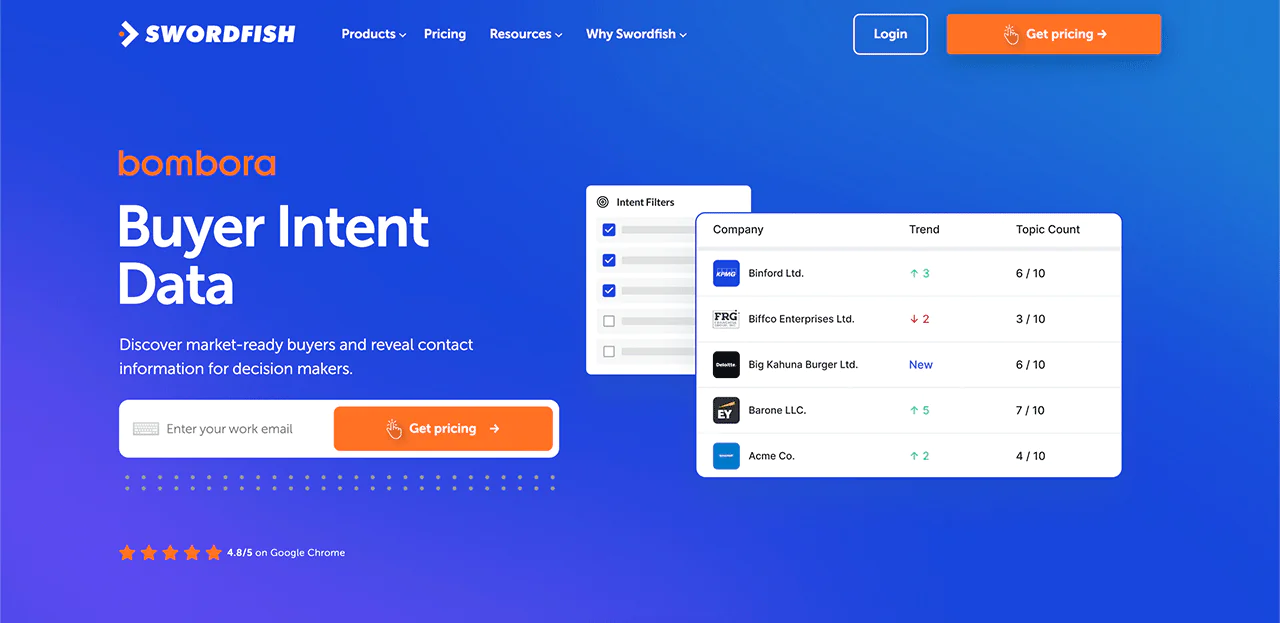

Bombora Intent Data

By accessing Bombora® Intent Data, you can identify which companies are actively researching financial services. This insight allows you to target your outreach to prospects that are most likely to be interested in financial advising, increasing your chances of conversion.

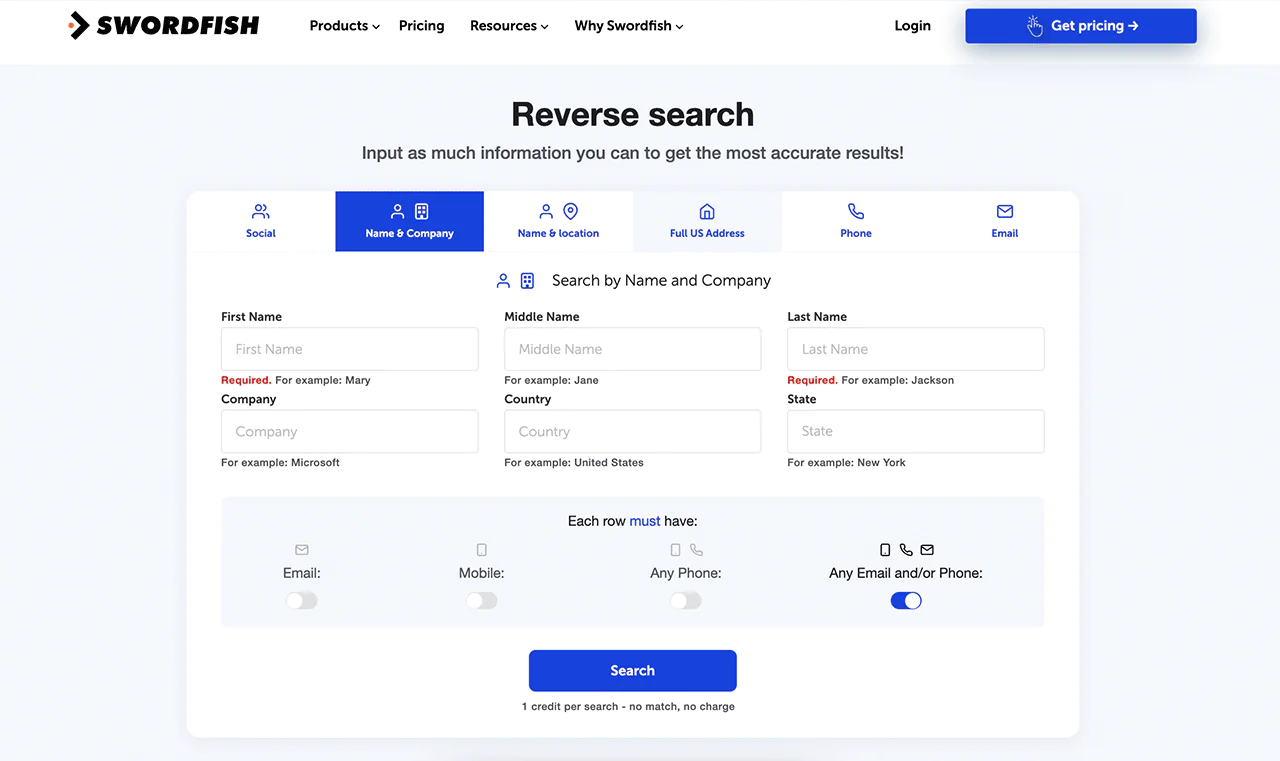

Reverse Search

If you have partial information, the Reverse Search lets you complete missing details. Just input an email or phone number, and the tool fills in the gaps, providing you with full contact data to reach out effectively.

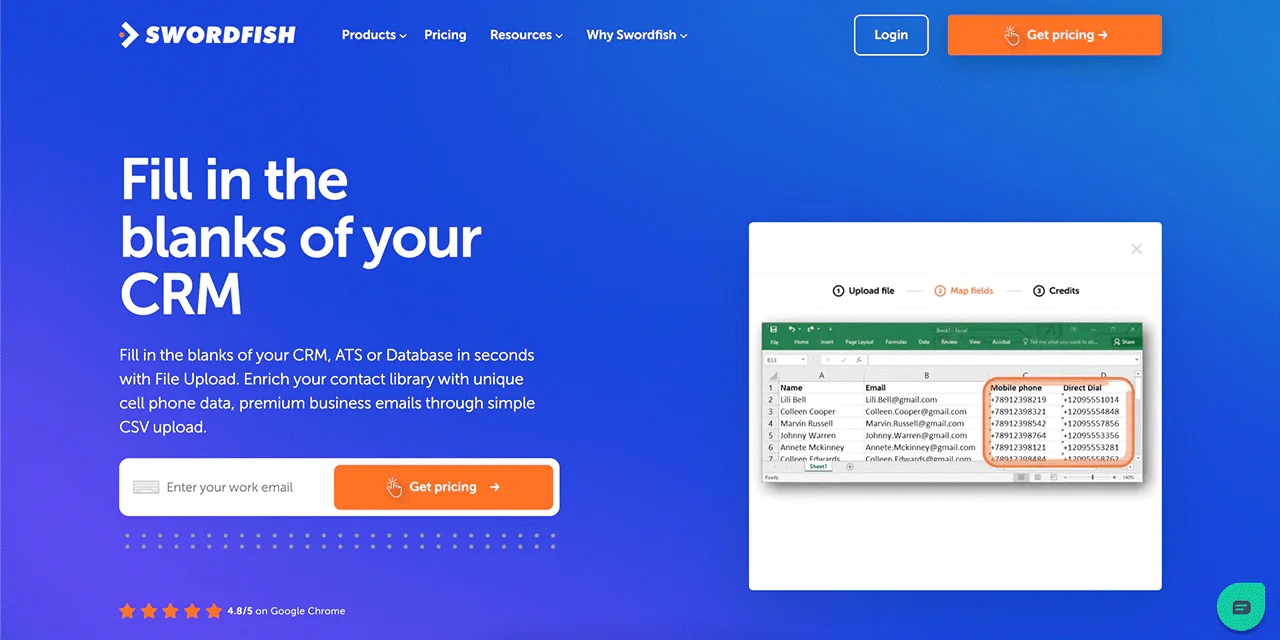

File Upload

The File Upload feature enables you to import your existing contacts and enhance them with additional data from Swordfish AI’s extensive database. This enrichment process helps you update and expand your leads with current, actionable information.

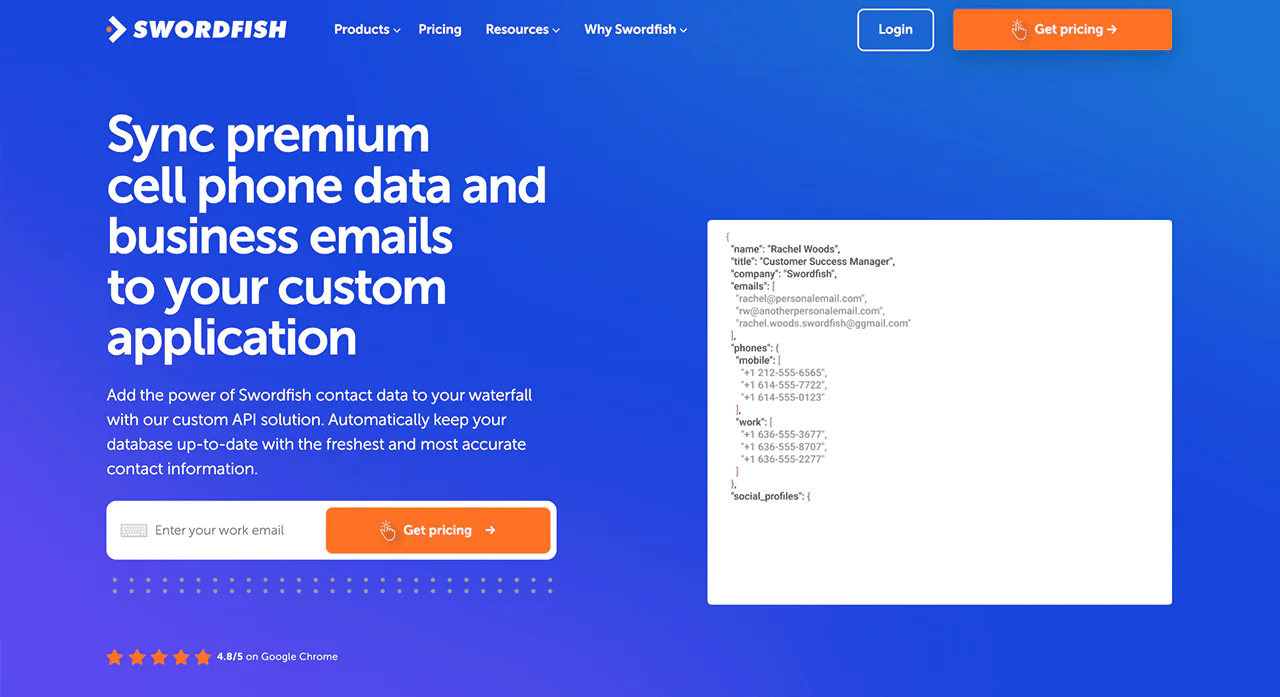

API Integration

Integrate Swordfish AI directly into your existing CRM or marketing software using its API. This integration eases your workflow, ensuring that lead information is automatically updated and readily accessible within your systems.

2. SEO for Financial Services

Search Engine Optimization (SEO) is an essential strategy for financial advisors who want to increase their online presence and attract more leads.

By strategically incorporating keywords like “investment strategies,” “personal finance advice,” and “retirement planning tips” into your content, you increase your search engine visibility.

Notably, mobile queries for “what should I invest in?” have increased by 65% year-over-year. By optimizing your SEO or creating paid search ads for these terms, you can capture the attention of consumers actively seeking investment advice.

It’s important to consistently produce high-quality content that addresses your audience’s financial concerns and questions.

For example, publishing detailed articles like “How to Manage Your Investments During Economic Downturns” specifically targets those seeking advice during uncertain economic periods.

This focused content draws in traffic from individuals seeking specific financial guidance. It also increases engagement and establishes you as a trustworthy expert in the financial field.

By regularly updating your website with valuable and relevant information, you maintain and improve your search rankings. Thus making it easier for potential clients to find your services when they need financial advice.

3. Targeted Content Marketing

Content marketing is a strategic approach aimed at creating and distributing valuable, relevant, and consistent content to attract and retain a clearly-defined audience.

For instance, you might develop a series of blog posts that detail the complexities of estate planning or produce videos explaining various investment strategies.

Each piece of content should serve to address the specific needs and questions of potential clients, thereby establishing your authority and trustworthiness in the financial sector.

Effective content marketing can lead to higher engagement rates, with more prospects reaching out for consultations.

4. Social Media Engagement

Social media platforms like LinkedIn, Twitter, and Facebook provide a vibrant platform for financial advisors to engage directly with potential clients. By maintaining an active presence, sharing insightful articles, and contributing to discussions, you can attract individuals who are actively seeking financial advice.

For example, consider hosting a weekly Facebook Live session titled “Money Management Mondays,” where you address common financial questions and provide practical advice.

This regular interaction not only helps in building a community of engaged followers but also establishes your credibility as an expert in financial matters.

As trust in your expertise grows, followers are more likely to consider your services when they need financial guidance. Thus effectively transforming social media engagement into an effective lead generation tool.

Notably, the financial services sector accounts for over 14% of overall spend in online advertising. This highlights the importance and effectiveness of digital engagement in this industry.

5. Email Marketing Campaigns

Email marketing remains one of the most effective ways for financial advisors to maintain contact with potential leads and nurture those relationships over time.

By sending out well-crafted emails that offer personalized advice, updates on financial trends, or follow-ups to previous interactions, you create a continuous touchpoint with your target audience.

For instance, after hosting a webinar on “Investment Strategies for Uncertain Times,” you could send a series of emails that go deeper into the topics discussed. These emails can provide additional resources or invite feedback from attendees.

Each email should highlight your expertise and value, motivating recipients to schedule a detailed, personal consultation to further explore financial solutions.

This strategy maintains engagement between major marketing initiatives and builds a pipeline of warm leads who trust and recognize your financial expertise.

Notably, for every $1 invested in email marketing, the average return on investment is an impressive $42. Thus highlighting the remarkable efficiency and profitability of email marketing in the financial advisory sector.

6. Financial Seminars and Networking

Hosting or participating in financial seminars and networking events provides a powerful platform for direct lead generation strategies for financial advisors. These events allow you to showcase your financial expertise to an audience actively seeking advice and solutions.

For instance, conducting a seminar titled “Investment Opportunities in the Current Market” draws individuals interested in the latest market trends. It also establishes you as a knowledgeable leader in the field.

Offering a free consultation to attendees can effectively turn their initial interest into concrete leads.

This approach not only educates the audience about current opportunities but also creates a personal connection. This is important for building trust and encouraging future business relationships.

7. Client Referral Programs

Client referral programs are an effective way to utilize your existing client base to generate new leads. Offering incentives like service discounts or gift cards motivates clients to actively promote your business within their personal and professional networks.

For example, providing a 10% discount for each successful referral incentivizes your clients to refer others who may need financial advisory services.

This method extends your reach through trusted networks. It also reinforces loyalty among your current clients, as they directly benefit from participating in the growth of your practice.

8. Educational Webinars

Webinars serve as an excellent tool for demonstrating your expertise and engaging directly with a wide audience interested in financial planning.

By organizing webinars on topics like “Maximizing Your Retirement Savings,” you attract individuals keen on improving their financial health.

Offering a personal consultation at the end of the webinar can convert participants’ interest into actionable leads. This method does more than just inform—it engages prospective clients in a dialogue. Thus making them feel valued and more inclined to explore further services.

By providing valuable information and an easy pathway to deeper engagement, webinars effectively bridge the gap between initial contact and client acquisition.

Who Needs Financial Advisor Leads?

Financial advisor leads are essential for various professionals in the finance industry. Here’s a look at who specifically needs these leads and why:

New Financial Advisors

New financial advisors who are building their client base need a steady stream of leads to establish themselves in the target market. Generating quality leads is crucial for them to kick-start their practice and begin forming long-term client relationships.

Established Financial Firms

Established financial firms also require fresh leads to maintain growth and replace clients who naturally attrite over time. Even successful firms need to continually engage new prospects to ensure a healthy business turnover and expansion.

Independent Financial Advisors

Independent financial advisors, operating without the backing of large firms, rely heavily on leads to sustain and grow their business. For them, consistent lead generation is vital to remain competitive and profitable in a market filled with bigger players.

Boutique Financial Planning Firms

Boutique firms, which often cater to niche markets or offer specialized services, need leads to find the right clients who seek their unique expertise. Generating targeted leads helps them connect with individuals or businesses that can benefit most from their personalized approach.

Wealth Management Advisors

Wealth management advisors, focusing on high-net-worth individuals, require a continuous influx of leads to find suitable clients who need complex financial strategies and management. Leads provide the opportunity to expand their client base and increase assets under management.

How Much Does Financial Advisors Leads Cost?

The cost of leads for financial advisors can vary significantly depending on the quality, source, and method of acquisition. Here’s a detailed look at what financial advisors might expect to pay for leads:

Online Lead Generation Platforms

Many financial advisors use online platforms that specialize in generating leads specifically for financial services. These leads can range from $20 to $100 each, depending on how detailed and vetted the leads are.

Paid Advertising

Costs for leads generated through paid advertising (like Google Ads or Facebook Ads) can vary based on the competition for keywords and targeting criteria. Typically, financial advisors might spend anywhere from $50 to $250 per lead, with the understanding that not all leads will convert into clients.

Lead Buying Services

Specialized services that sell pre-qualified leads to financial advisors typically charge more, as these leads are expected to have a higher likelihood of conversion. Prices for these services can range from $100 to $300 per lead, depending on exclusivity and qualification criteria.

Referral Networks

Participating in referral networks often involves a membership fee plus a success fee for each lead that converts into a client, with costs varying widely. These costs can be a combination of fixed annual or monthly fees coupled with variable costs tied to client acquisition.

Buying Leads in Bulk

Purchasing leads in bulk often reduces the per-lead cost. This can be a viable option for larger firms or for those planning extensive campaigns. Bulk leads can be bought for as little as $20 to $100 per lead, depending on the volume and quality.

Networking and Events

While indirect, the cost of acquiring leads through networking and attending industry events also factors into overall expenses. These costs are more diffuse but include event entry fees, travel costs, and time spent, with the potential lead cost being highly variable.

Conclusion

So far, we’ve explored various strategies to effectively generate financial advisor leads, highlighting the importance and challenges of this process. Generating qualified leads is essential for growing your client base and staying competitive.

The difficulties in acquiring these leads can be significant, but Swordfish AI stands as the best financial advisor leads provider among all.

With its advanced targeting and data-driven approach, Swordfish AI enables financial advisors to connect with high-quality prospects efficiently. So, make sure to try Swordfish AI!

To buy email list of financial advisor, you can check our Financial advisor email list for insights.

Frequently Asked Question

What tools can help manage and track financial advisor leads?

CRM (Customer Relationship Management) systems are essential for managing, tracking, and nurturing leads through the sales funnel. These systems help organize lead information, monitor interactions, and automate communications, ensuring no opportunities slip through the cracks.

What are some common challenges in generating leads for financial advisors?

Common challenges include high competition, capturing the interest of qualified prospects, and effectively nurturing leads into clients. Financial advisors must differentiate themselves in a crowded market and develop strong follow-up strategies to maintain interest and engagement from potential clients.

Is email marketing effective for financial advisor lead generation?

Yes, email marketing allows for targeted communication, helps nurture leads, and keeps your advisory top of mind among prospects. By providing valuable content and regular updates, email marketing can strengthen relationships with leads and increase the likelihood of converting them into clients.

View Products

View Products